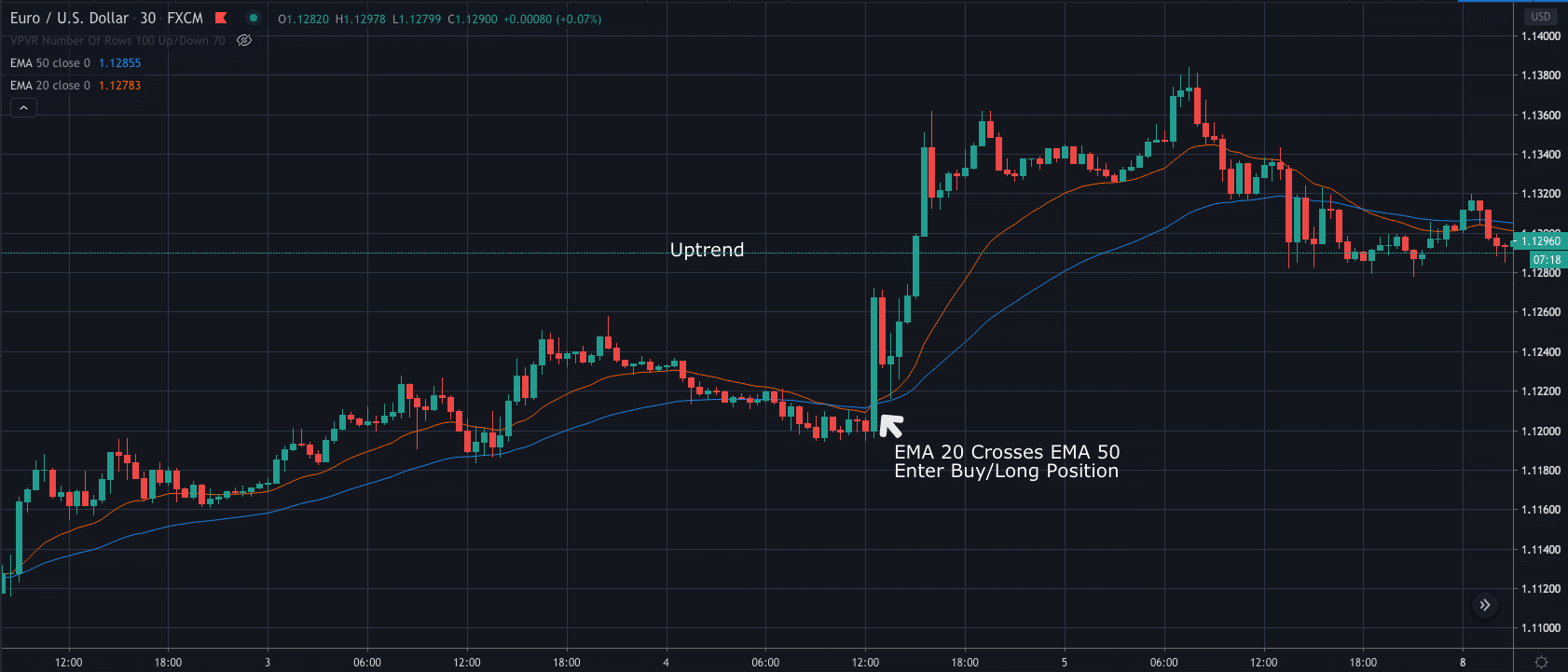

The 20 day moving average is a popular technical indicator that can be used to trade breakouts. For example, traders are bullish when the 20 EMA crosses above the 50 EMA or remains above the 50 EMA, and only turn bearish if the 20 EMA falls below the 50 EMA. This moving average is powerfully indicator of a stock’s trend, and can help a trader to make money in both the long and short term.Ī common trading strategy utilizing EMAs is to trade based on the position of a shorter-term EMA in relation to a longer-term EMA. The 200-day EMA is a moving average that is used by many traders to help them make decisions about their trades. Shorter moving averages will thus appear to move more, and longer ones less. The 200-day MA will tend to be smoother than the 50-day MA because it incorporates more data into its average. The 200-day MA is a popular long-term MA. It is a trend-following indicator that is based on past prices – the longer the time frame used to calculate the MA, the smoother the price action. This is because the 20-EMA is the most sensitive to price changes and the fact that it is crossing below the 50-EMA while the 50-EMA is below the 200-EMA indicates a strong shift in trend.Ī moving average (MA) is a technical analysis indicator that helps smooth out price action by filtering out the “noise” from random price fluctuations. If the 20-EMA crosses below the 50-EMA while the 50-EMA is BELOW the 200-EMA, the signal is especially bearish or a sell/short trend change. Traders use this technical indicator to get buying and selling signals that come from crossovers and divergences of the historical averages. It quickly responds to recent price changes than to older price changes. The EMA indicator is one of the best indicators for scalping. Many traders use the 200 EMA as a key point at which to enter or exit a trade. Similarly, if the price is below the 200 EMA, it is generally considered to be in a downtrend. If the price is above the 200 EMA, it is generally considered to be in an uptrend. The 200 Exponential Moving Average is a key indicator that is used by many traders to determine the overall trend of the market. What happens when 20 EMA crosses 200 EMA? This means that you would only enter a trade when the price action is above or below the 200-period EMA (depending on the direction of the trend), and exit when the price action crosses back above or below the 20-period EMA. However, a common approach is to use a 20-period exponential moving average (EMA) for your trend filter, and a 200-period EMA for yourentry/exit signal. There is no one-size-fits-all answer to this question, as the optimal strategy will vary depending on the specific market conditions and timeframe that you are trading. If the price is below the 200 EMA, it is in a downtrend. If the price is above the 200 EMA, it is in an uptrend. The 200 EMA is used as a trend indicator. The basic idea is to buy when the price is above the 20 EMA and sell when it is below the 20 EMA.

The 20 and 200 exponential moving average (EMA) strategy is a very popular technical analysis technique.

4 What happens when 20 and 50 EMA cross?.3 Which is the best EMA crossover strategy?.

2.1 Which time frame is best for 200 EMA.2 What happens when 20 EMA crosses 200 EMA?.

0 kommentar(er)

0 kommentar(er)